Loans For African American Women-Owned Business Owners

Women are the most complex mixture of beauty and endurance; both history and the modern world have proven the legitimacy of the presence of women in every field and among them, as owners of small businesses.

Women in business are thriving thanks to their proactivity and their desire to challenge themselves and change the word even if it just brings a smile to their local neighborhood. Starting a small business is the first step to realize your dream and finally bring your vision to life.

“African-American Women: Our Science, Her Magic,” which Nielsen released today (September 21), uses U.S. Census data to quantify Black women’s power to influence the economy, media and politics. Data from the 2015 Survey of Business Owners shows that the number of businesses majority-owned by Black women grew 67 percent between 2007 and 2012, compared to 27 percent for all women and 13 percent for White women. Nielsen quantifies that growth at 1.5 million Black woman majority-owned businesses as of 2015.

Acquiring funds for small and micro projects face women from all the backgrounds, especially those coming from minority communities can be especially challenging. Being a woman of color and seeking to grow your business is hard, as the small business loans proposals are usually declined for various reasons.

Even if you provide a well-documented business plan alongside with the target audience of your business, the right financial procedures you are conducting in your already existing small business and the proof of the growth of your business, banks are likely to reject it because it presents higher risks as monetary institutions seek higher profits.

Keep your hopes up if you want to grow your business because there are many institutions other than banks working to provide a woman with the best help.

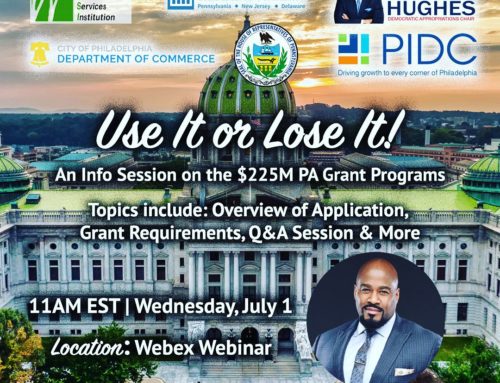

The West Philadelphia Financial Services Institution or the WPFSI is an SBA/CDFI lender that supports women who need small loans for small businesses. As a nonprofit organization, its only aim, since the day of its foundation, is to help ambitious women in business with a leadership spirit economically and boost their small businesses.

Obtaining small loans are very important to extend a small business and help give more credibility and visibility to the wheel of the economy of the country. Gaining visibility in the market is now harder and requires putting considerable effort into it even when the services provided are of high quality and affordable prices.

In addition, providing quality and low-cost services or products need more investments, in other words, money to use for both the primary products or service and to hire quality staff.

Beauty Salon Owners

In the U.S., black female salon owners are among the most successful entrepreneurs in their communities. And no wonder, considering how much money African-American women spend on hair care and beauty needs.

African-Americans spend an estimated $5.7 billion a year in the beauty and barber industry, and black women visit the salon an average of 2.5 times a month, data from the research firm Business Trend Analysts Inc./The Leading Edge Group, of Commack, N.Y., show.

Salon owners are one such group that is often shunned by traditional lending institutions. If you are a salon owner who has struggled to obtain a small business loan, you are welcome to join the WPFSI community.

Because you often need help to navigate the changes that face small businesses; from acquiring the right space, expanding your existing space or marketing your hairdressing services, the WPFSI is here to help you get the funding you need.

Hi – I would like to use one of your images for my website. Please let me know if this is also okay. I would also like to inquire about funding, we are working on a beauty app. Let me know what you think on both matters. Thanks!

Hello Cari,

Which image were you interested in using? Also, please see: How to Pre-Qualify for a Loan regarding funding options.