What You Need To Know About Credit

Whether you are a small business owner, hard-working consumer or college student, having good credit is essential to everyday life these days.

Poor credit creates all types of hardships.

If you own a business it can mean not being able to get the necessary financing to expand your operations, purchase needed equipment or being able to raise working capital.

As a consumer, since so many businesses now judge you based on your credit score, having bad credit can make life extremely difficult, from getting a job to getting a place to live.

Here are just some of the most common side effects of bad credit.

- High-interest rates on your credit cards and loans

- Credit and loan application may not be approved

- Difficulty getting approved for an apartment of mortgage

- Having to pay security deposits on utilities

- Not being able to get a cell phone contract

- You might get denied for employment

- Higher insurance premiums

- Calls from debt collectors

- Difficulty starting your own business

- Difficulty purchasing a car

No matter how bad your credit is right now, the damage isn’t permanent. Credit repair allows you to fix the mistakes hurting your credit and improve your credit score.

Repairing your credit is critical to saving money on insurance, loans, and credit cards, but that’s not the only reason to repair your credit. Better credit opens up new employment opportunities, even promotions and raises with your current employer. If you dream of starting your own business or just want the security of knowing you can borrow money when you want to, you should repair your credit sooner rather than later.

Nearly 60% of Americans “DO NOT” Know What Their Credit Score Means!

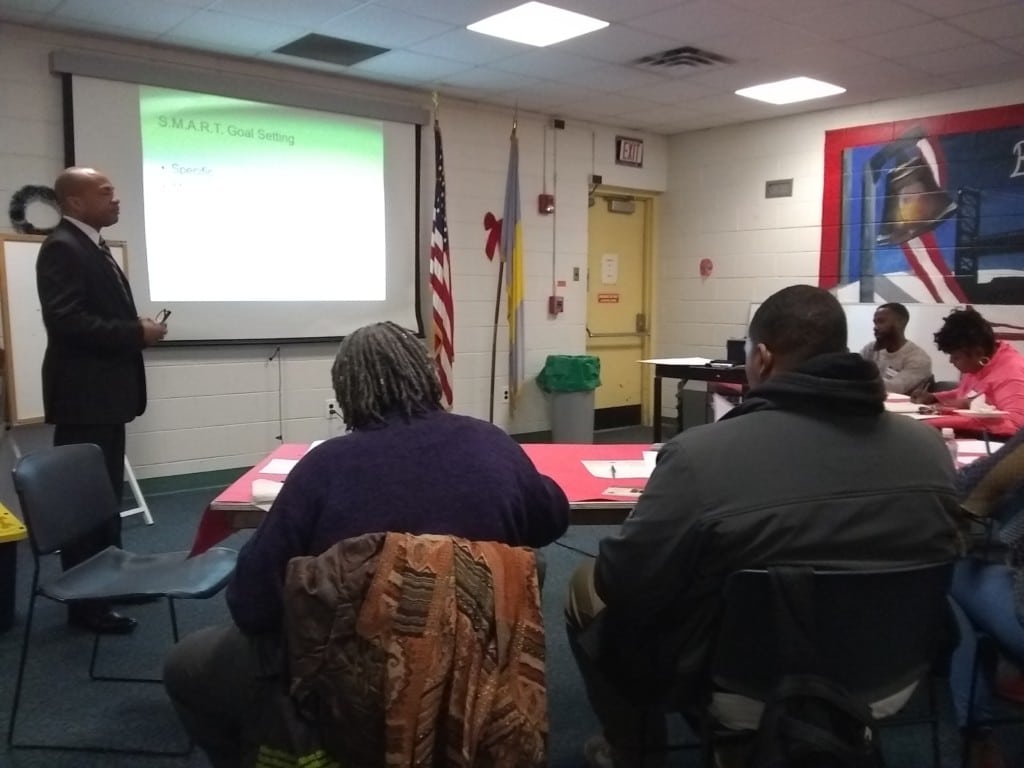

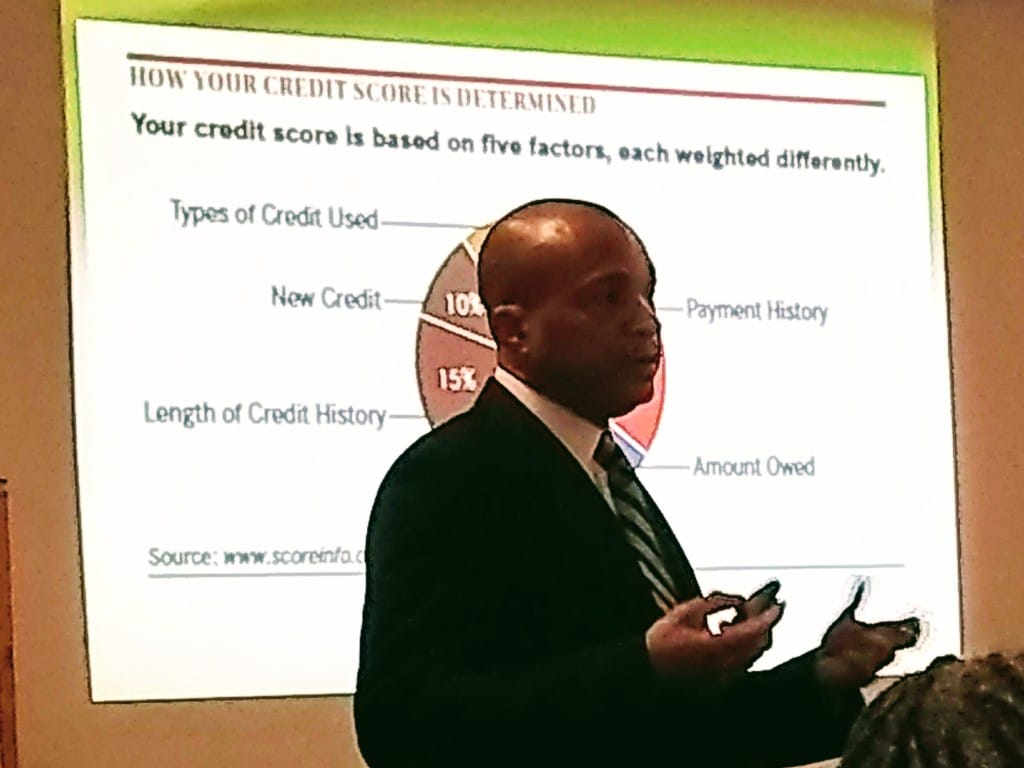

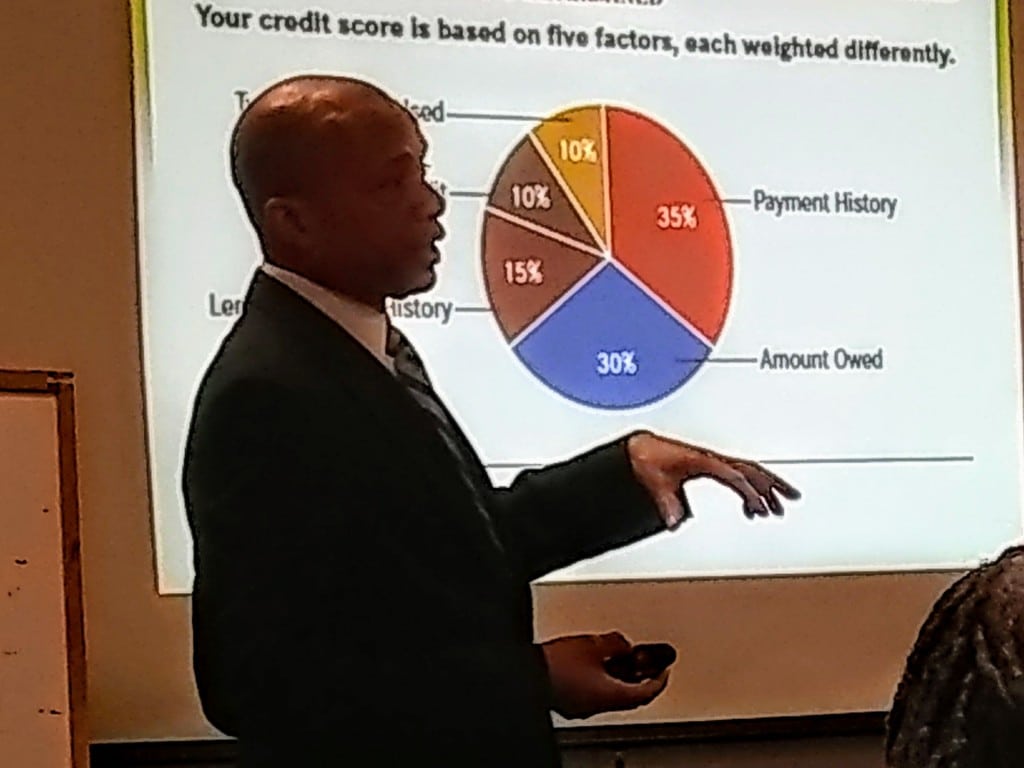

To address the many myths and misconceptions about credit ratings and credit reports, DaeWes Credit Solutions is collaborating with WPFSI to educate consumers and business owners on the topic of credit & creditworthiness. Twice a quarter, “What You Need To Know About Credit” workshops are held at convenient locations throughout Philadelphia and are free to attend.

What You Will Learn…

As a Consumer, you deserve to understand how credit works and in these interactive workshops, you will learn how to improve your creditworthiness to prevent you from missing out on financial opportunities. Register below and discover…

- How to establish business credit

- How to raise your credit score

- How to rebuild your credit

- How to maintain good credit scores

- How to avoid credit pitfalls