WPFSI – SBA Microloan Intermediary Lender

As an SBA Microloan Intermediary, WPFSI provides loans up to $50,000 for Working Capital, Inventory or supplies, Furniture or fixtures, and Machinery or Equipment to eligible borrowers. Learn more about the benefits of the SBA Microloan Progam below as well as eligibility requirements.

Microloan program provides loans up to “$50,000” to help small businesses…

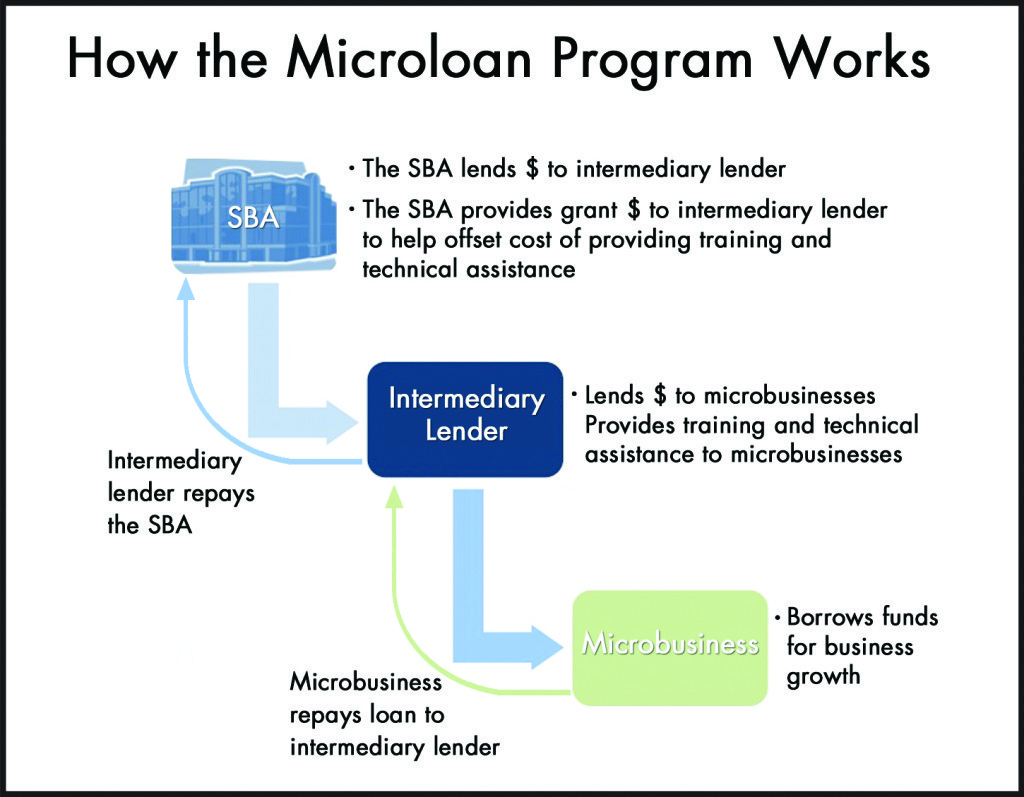

The U.S. Small Business Administration provides funds to specially designated intermediary lenders, which are nonprofit community-based organizations with experience in lending as well as management and technical assistance. These intermediaries administer the Microloan program for eligible borrowers.

How The SBA Microloan Program Works

- The Microloan program provides loans up to $50,000 to help small businesses and certain not-for-profit childcare centers start up and expand.

- The average microloan is about $13,000.

- The U.S. Small Business Administration provides funds to specially designated intermediary lenders, which are nonprofit community-based organizations with experience in lending as well as management and technical assistance. These intermediaries administer the Microloan program for eligible borrowers.

- Eligibility Requirements. Each intermediary lender has its own lending and credit requirements. Generally, intermediaries require some type of collateral as well as the personal guarantee of the business owner.

- Use of Microloan Proceeds. Microloans can be used for:

- Working capital

- Inventory or supplies

- Furniture or fixtures

- Machinery or equipment

- Proceeds from an SBA microloan cannot be used to pay existing debts or to purchase real estate.

- Repayment Terms, Interest Rates, and Fees. Loan repayment terms vary according to several factors:

- Loan amount

- Planned use of funds

- Requirements determined by the intermediary lender

- Needs of the small business borrower

- The maximum repayment term allowed for an SBA microloan is six years.

Interest rates vary, depending on the intermediary lender and costs to the intermediary from the U.S. Treasury. Generally, these rates will be between 8 and 13 percent.

“WPFSI” is here to help your grow your business…

About WPFSI… More Than Just A Lender!

The West Philadelphia Financial Services Institution (WPFSI) is a community-based, 501 (c) (3) nonprofit financial services corporation founded in 1997 to facilitate economic empowerment opportunities within the West Philadelphia Empowerment Zone (census tracts 105 and 111).

WPFSI now focuses its energies and resources on entrepreneurs, residents, and businesses living and/or operating throughout the city of Philadelphia. As part of this mission, WPFSI has helped hundreds of entrepreneurs who are underserved by traditional financial institutions by providing capital, consumer and business training, pre and post financial technical assistance and real e=state development. This work is a central part of WPFSI’s innovative response to the needs of entrepreneurs living in low-income neighborhoods.

WPFSI’s activities are focused on three specific areas: loan origination/financial intermediation (i.e., loan brokerage), real estate development and financial education, primarily through our WesGold Fellows internship program.

Loan Origination & Technical Assistance

WPFSI provides direct financing to small businesses through loans of up to $100,000, intermediary services for loans over $100,000 and offers seminars and technical assistance (pre & post financing) to local entrepreneurs. WPFSI has also entered into a Memorandum of Understanding with The Business Center for Entrepreneurship & Social Enterprise to provide additional business and technical assistance at a low cost, when necessary, for our clients.

WPFSI currently has over $500,000 in capital investments in the community through a combination of term loans, contract loans, construction loans and loan guarantees. These loans have allowed WPFSI to leverage $2 million in additional capital from government, banks, financial institutions and owner’s equity.

Through loan origination and financial intermediation services, WPFSI has been particularly successful within the Target Market. Working over the last 19 years within the Empowerment Zone, which a federally-funded economic development initiative, WPFSI has lent about $5 million to support small businesses, home ownership and other forms of economic revitalization. Over the past ten years, WPFSI has leveraged financing for a variety of small and mid-size businesses which have created some 110 jobs for Target Market residents.

Real Estate Development

WPFSI has developed and co-developed five real estate projects in Philadelphia. Our projects focus on the development of challenged properties or those located in distressed communities. We also focus on a development process that includes community members in each phase of development. Our most recognizable project, which leveraged approximately $55 million in private and public (land, cash, and grants) investment in the community, is the ParkWest Town Center. Co-developed with The Goldenberg Group, the Town Center is a 341,000-square-foot shopping center that created over 650 new jobs and transformed a blighted neighborhood in West Philadelphia into a thriving community. WPFSI uses the returns from the Town Center to fund our work to facilitate empowerment and wealth building in the surrounding community.

Currently, we are partnering with Philadelphia University to transform the storm water detention basin area of ParkWest Town Center into a green community space that would be a destination for the nearby community. Philadelphia University’s College of Architecture and the Built Environment has already held a charrette with local residents and stakeholders to engage them in the development process.

With this and other development projects, our goal is to identify opportunities similar to the ParkWest Town Center which will stimulate future investments in communities by creating the foundation for community development. We also look to design spaces that will engage and enrich the community in a sustainable way.

Financial Education & WesGold Fellows Internship Program

WPFSI provides business training to its borrowers, business owners and those interested in starting businesses. Through this work, 250 individuals and businesses have received support from industry experts through annual business training sessions with industry experts. These training sessions are now in their eighth year. Additionally, 109 high school students have been provided with a series of 14 financial literacy classes.

WPFSI also offers financial and development technical assistance to borrowers and non-borrowers at no charge. Finally, we educate the broader community about financial issues through our monthly podcast “There’s Money Out There.”

Another WPFSI program, the WesGold Fellows (WGF) internship program, was created in 2007 in conjunction with the development of the Town Center. WGF was initially designed to increase youth awareness of and exposure to large-scale real estate development and its impact on the community. Since then, WGF has grown and expanded its mission to offer 15 deserving high school students with a paid summer internship that provides them with the skills they need to start or own their own business. To date, more than 70 students have participated in the program.

WPFSI also provides financial and development technical assistance to borrowers and non-borrowers at no charge. WPFSI has also begun an extensive walking tour of the target market businesses to ascertain capital and other business or technical assistance related needs.

The Board of WPFSI continues to monitor the effectiveness of our delivery system for the financial products and services, technical assistance, development services and training components that we typically provide to the Target Market through Community and Business Surveys and community meetings that are conducted periodically throughout the year. Furthermore, the Board has approved a Strategic Plan which includes an aggressive strategy to raise approximately $25 million over the next five (5) years to fund a new Loan Fund to meet some of the financial needs in the Target Market.