Acquiring small business loans for women-owned businesses can be unpredictable and challenging.

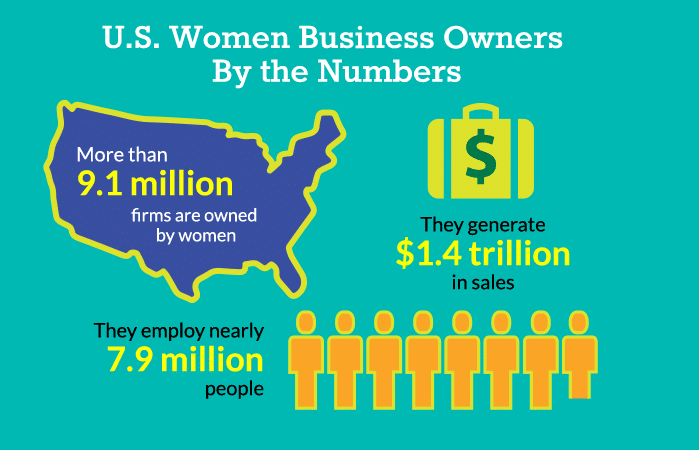

According to the Washington Post, “Women today have a huge impact across all sectors of the business world and our economy”. And, a report from the U.S. Small Business Administration, states that “women now make up 47 percent of the country’s workforce, controlling $14 trillion, or 51 percent, of personal wealth in the U.S. and are now the primary source of income in over 40 percent of households”.

BUT… Women entrepreneurs seeking capital are more likely to be turned down for loans than men,

with only one in 23 dollars in loans going to a woman.

However, for women who own small businesses, securing capital to grow or expand their businesses still remains a challenge. women entrepreneurs seeking capital are more likely to be turned down for loans than men, with only one in 23 dollars in loans going to a woman.

In a Babson College study, it was found that, despite the fact that 36 percent of small businesses in the U.S. are women-owned, businesses owned exclusively by men are four times as likely to receive venture capital funding.

Where to start when looking for small business loans

The lender – An essential factor to consider when shopping for capital is the lender. As a woman business owner, you need a trustworthy lender who understands your needs and is willing to work with you in putting together the best type of loan for your business. It is vital to choose wisely.

One of the most recognized business lenders is WPFSI.

West Philadelphia Financial-Services Institution (WPFSI)

West Philadelphia Financial Services Institution is a non-profit organization established to offer economic development leadership and loans to business owners in Philadelphia and surrounding counties. They are a Certified CDFI and SBA Lender.

WPFSI is bridging the gap between women entrepreneurs and the capital they need to grow their businesses. Their loan opportunities connect women business owners with affordable loans, administered through community development financial institutions (CDFIs), which provide capital and technical assistance to underserved markets and populations, who might otherwise have trouble accessing financial services like this.

Since it was formed, WPFSI has produced tangible results for many residents and business owners.

Vital Step Therapy and Fitness

In 2015, when the owners approached WPFSI about opening the startup practice, they needed a loan for approximately $37,000.00 to purchase equipment and working capital to make some leasehold improvements and payroll. The doctors had prepared a very thorough business plan. Because of their experience and business preparation, WPFSI was able to provide the necessary financing to help make their dream to open their own business a reality.

“We are very passionate about making an impact in our local community because we have spent many years here as clinicians, residents, and graduates from the University of the Sciences in Philadelphia (also located in West Philly),” Aryee and Brown told A Woman’s Nation.

See: Vital Step Physical Therapy & Fitness opens on 50th and Baltimore

Apart from providing capital to small business people, WPFSI offers community services such as youth development support, financial education, and several programs to enrich the lives of youths, women, and families in Philadelphia.

Looking for a Small Business Loan – Contact WPFSI Today

If you need a small business loan, WPFSI can make that happen. All you need are loan application form, both business and personal tax returns for the last three years, personal-financial statement of business owners, cash-flow projections, and a business plan.

Created to help small business owners achieve financial freedom, WPFSI organization is more than a lender.

Hence, once your application is received, WPFSI takes the time to understand your business goals. Then they develop a financial solution that works best for your business.

So, no matter your background or the size of your business, you can trust WPFSI.